Apocriphal - Validation of Third Party Invoices for SAP

SAP Services

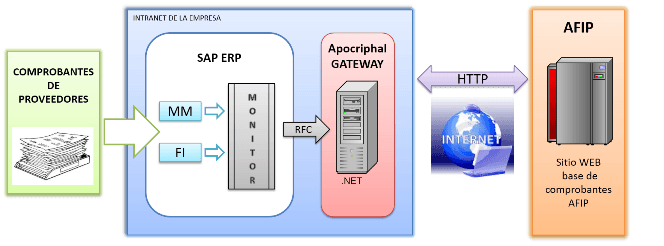

Request developed a solution that allows validating the authenticity of Invoices issued by third parties with CAI, CAE and CAEA.Al enter a supplier invoice in SAP, it is verified in AFIP whether or not it is apocryphal through an automatic online connection developed by Request.

The Tax Procedure Law 25.795 (B.O.17/11/2003) regulates in its article 33.1: “Taxpayers will be obliged to verify that the invoices or equivalent documents they receive for their purchases or locations, are duly authorized by the Federal Administration of Public Revenues.”

Automated Invoice Verification

Leverage an automated system to validate supplier invoices through real-time AFIP checks, ensuring accuracy and reducing manual errors.

Compliance with Tax Regulations

Ensure compliance with legal requirements by verifying that all purchase invoices are authorized by the Federal Administration of Public Revenues (AFIP).

In 2003 there was only the CAI to objectively validate a third-party voucher against AFIP, today with the implementation of the issuance of electronic vouchers with CAE and CAEA, the AFIP returns to the load requiring companies to control their purchase vouchers objectively. To this end, it makes available to the consumer manual consultation websites to carry out these validations.

REQUEST presents the VFA-Gateway solution, a tool capable of automating the process of consulting the veracity of purchase receipts before AFIP.